If Democrats want to keep their majorities in Congress in the 2022 midterms, they need to move fast on a $15 minimum wage increase.

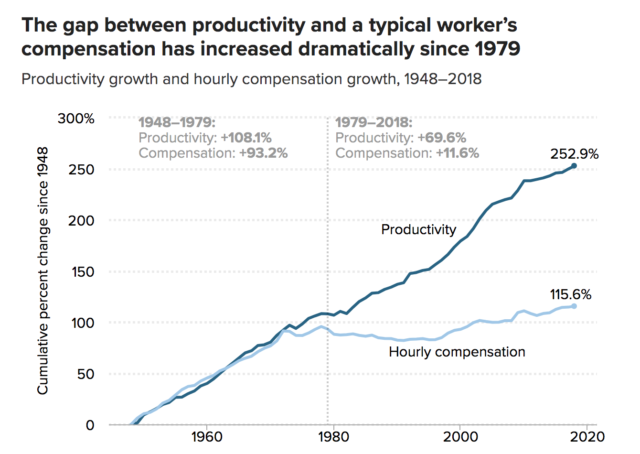

According to an analysis by the Economic Policy Institute of data from the US Bureau of Labor Statistics from 1948 to 2018, worker productivity has skyrocketed while worker compensation has stayed stagnant. The graph below shows just how wide that gap has gotten.

In fact, if the minimum wage had increased so as to adjust for inflation and keep worker productivity even with compensation (as it was in the 1950s and 60s when America’s middle class was thriving much more), today’s minimum wage would be well above $20. Obviously, raising the minimum wage by that much would shock the system and lead to an economic downturn, so at least as of now, that proposal is unfeasible.

However, it’s clear that wages have stagnated, and it’s clear half a century of trickle-down economics, also known as Reaganomics after former President Ronald Reagan who first implemented the economic theory, has not boded well for the middle class. Instead, it has exacerbated the wealth gap and failed to fairly compensate people for their work.

As a result, people are tired. They are tired of working multiple jobs only to live paycheck to paycheck. They are tired of having to choose which medication to refill each month because they can’t afford all of the ones they need. And they’re tired of a Washington D.C. that continually fails to meet their needs.

But now, for the first time in a decade, Democrats finally have a majority in both chambers of Congress. They can pass this legislation, and if they don’t fulfill this promise (among others) to the American people, they give voters no reason to show up to the polls next year.

Opponents to the proposed minimum wage increase cite many areas of concern when it comes to the effects this increase might have on the economy. One of these concerns is that an increase of the minimum wage would cause a rise in prices, so much so that it will just cause inflation instead of actually helping people.

While there is certainly debate among economists on how much this wage increase would raise prices, several studies show that for every 10% increase in the minimum wage, prices only increase between 0.36% to 0.7%. To break it down further, changing the minimum wage to $15 is just slightly over a 100% increase from today’s baseline of $7.25. As such, predicted cumulative inflation rate over the five years it would take to reach $15 would cause an overall inflation rate of 3.6% to 7%.

However, from 2016 to 2020, the cumulative inflation rate was roughly 8.8%. Therefore, if prices are already rising at that rate without a minimum wage increase, what is the downside in implementing this change?

Perhaps, then people are nervous about a loss of jobs that would happen in response to a wage increase. In fact, earlier this week, the Congressional Budget Office put out an analysis that said that while a $15 minimum wage increase would lift 900,000 people out of poverty, it would cause 1.4 million jobs to be lost.

However, that’s just a cherry-picking of what the data reported. First, the report said that overall, 17 million workers would directly see an increase in wages with an estimated 10 million workers “whose wages would otherwise be slightly above” $15 per hour also likely to see a raise. Furthermore, this study only looks at the effects of the proposed minimum wage bill without taking into consideration jobs that would be created from other policy initiatives such as investing in clean energy, infrastructure and increasing access to education and healthcare.

Then, of course, there is the hurdle of how this wage increase will affect small businesses. First, it’s important to recognize that major corporations like Amazon and Target are already on their way to paying (or are already paying) their employees $15 per hour. Now, this editorial board is not one to praise Amazon on their working conditions and employee benefits, but large companies are already paying their workers at $15 per hour without a federal mandate to do so. If small businesses are going to have a hope at attracting any potential employees, they’ll have to raise wages to keep up.

Raising the minimum wage would be less of a problem for new businesses because starting a business is mostly paid for in one of two ways: independent wealth or investments and loans. The former obviously won’t need help in paying employees, while the latter almost always requires the potential business owner to lay out expenses for potential stakeholders. It would be illogical for lenders or investors not to give capital to a business owner if the cost of their proposal went up due to a federally-mandated wage requirement.

For existing small businesses, the wage increase poses a different set of challenges. A sudden increase in business expenses would be difficult for small business owners to manage without time to restructure their business model. However, in a Washington D.C. that can’t agree on much these days, both parties speak about the value of small businesses in America’s communities and that those businesses are worth investing in.

Surely then, Congress could pull enough votes together to put into place a 100%-forgivable loan program for small business owners that would provide them a three-to-four year loan after the minimum wage hits $15 in 2025 to help cover the cost of increased wages. This would give small businesses enough time to restructure their business model and if, at the end of the loan program, they are once again completely independent, the loan would be completely forgiven.

If you ask businesspeople what the primary purpose of a business is, you usually get one of two answers. The first is that businesses exist to provide goods or services to customers and provide jobs to a community. The second answer is that businesses exist to accrue wealth for shareholders.

For those who wish to add value to their community, surely they will come to the conclusion that paying employees a livable wage helps to better achieve that purpose. And for those that fall in the second camp, it’s clear that they primarily value individual prosperity as opposed to common good, and in a functional democracy, we should never make policy decisions based on what would result in excess wealth for a small group of people while allowing a large chunk of the workforce to flail.

As for now, however, the fight for $15 continues. Hopefully, 2021 is the year where we actually get somewhere.