College is expensive; we all know this.

For many of us, our parents strive to do all that they can to make our scholastic dreams come true by taking out loans. A recent investigative report published by ProPublica and The Chronicle of Higher Education found that a government loan called the Parent PLUS loan has seemed to harm more than it helped — not only the students’ financial stability but that of the parents’ as well.

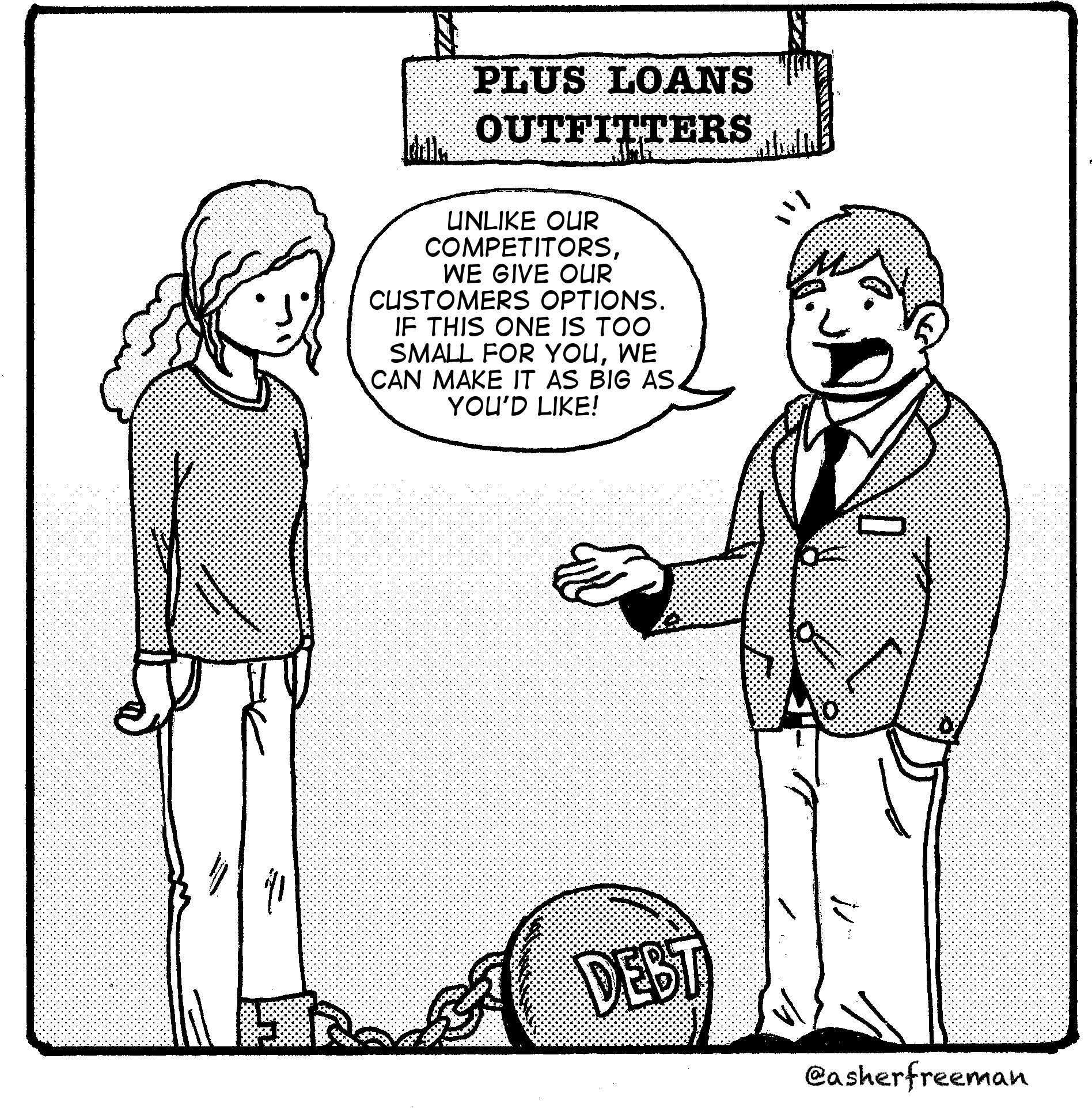

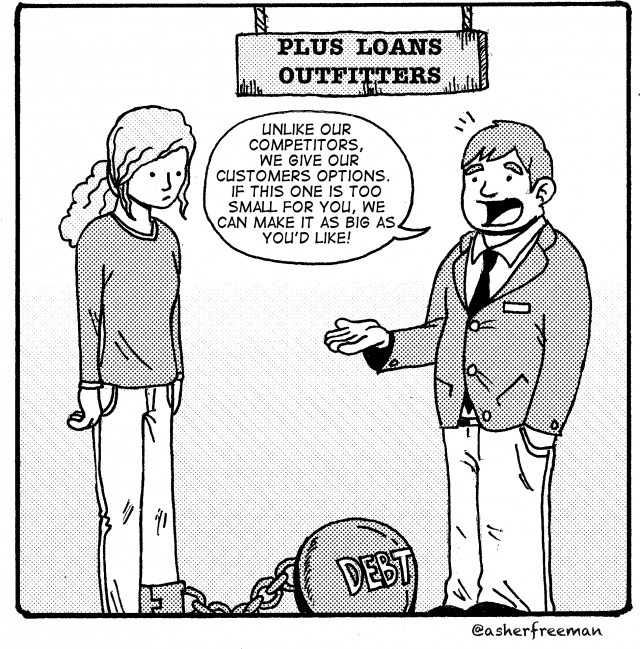

Applying for these loans takes mere minutes. The U.S. Department of Education, which runs the program, is qualifying applicants with no regard for their ability to repay.

They approve people with no verification of employment, income check and no knowledge of how much other debt they have taken on. All an applicant has to do is pass a simple credit check and as long as an adverse credit history is not found, they are usually approved in a matter of hours.

Last year the government handed out $10.6 billion in PLUS loans to almost a million families, averaging roughly $11,000 each per year. Even adjusted for inflation, that is $6.3 billion more than the PLUS loans disbursed in 2000.

There is no cap for the amount that can be borrowed through a PLUS loan. Parents can take out as much as the gap between other financial aid and the cost of attendance. There is a fixed interest rate of 7.9 percent, which is much higher than that of many other loans. Because these loans are remarkable easy to obtain in large amounts, parents are all too often overreaching, causing the loans to hurt the very people that they are intended to help.

Many colleges, including Baylor, firmly recommend the PLUS loan option to students in need. We believe that they do this because they are trying hard to increase admissions, and these loosely administered loans help colleges to achieve that goal.

Paying these loans back is much more challenging than acquiring them. Many parents are loaded with their children’s college debt, even upon retirement. Not only are these loans next to impossible to shed in bankruptcy, but if a borrower defaults on a PLUS loan, the government can seize tax refunds and garnish wages or Social Security. It is not fair that parents are bearing such hefty financial burdens for trying to provide their children with a decent education.

For PLUS loans, the government produces nothing more than its projections for budgetary purposes; it does not keep tabs on how many borrowers have defaulted on loans, or any of the related details as it does with other federal education loans.

The Department of Education defends its dedication to the PLUS loan system by saying that the priority is making sure college isn’t just for the wealthy and that it is a family’s responsibility to make responsible decisions about its finances and what it can reasonably pay back. What they don’t take into account is the “curb appeal” of offering a seemingly unlimited loan to a family that is in no position to repay that loan.

By taking on the PLUS loans, parents are finding themselves debating whether to raid their retirements, sell their houses or continue working far beyond capable ages in order to pay off the loans. Government assistance is supposed to lessen the financial strain of college on families, but instead PLUS loans are making the strain more than many people are capable of bearing.

In defense of the Department of Education, it has recently altered how it defines adverse credit history, adding unpaid collections accounts or charged-off debt as grounds for denial.

By doing this, department officials are hoping that it will help diminish the number of people from taking on debt they are unable to afford while protecting taxpayer dollars.

While this is a step in the right direction, this new definition still only examines the applicant’s credit history; it does not account their ability to repay the loans.

Even then, the borrowers who are denied can appeal the decision and still get the loans if they are able to convince the Department of Education that they have extraneous circumstances, or they can reapply with a co-signer.

The current PLUS loan limits for undergraduate students seem arbitrary. They do not account for the student or their family’s ability to repay the loans. We feel that rather than handing out PLUS loans that are seemingly detrimental to many families, the government should consider dispersing that money in a more responsible manner to help students pay for college expenses.

The Department of Education should hold those PLUS loan applicants to the same approval standards as those of other government funded aid in order to prevent sending families into downward financial spirals.

For more information on the study of Parent PLUS loans by The Chronicle of Higher Education and ProPublica as well as a list of colleges where borrowers took out the highest amount of PLUS loans per year, visit www.baylorlariat.com.