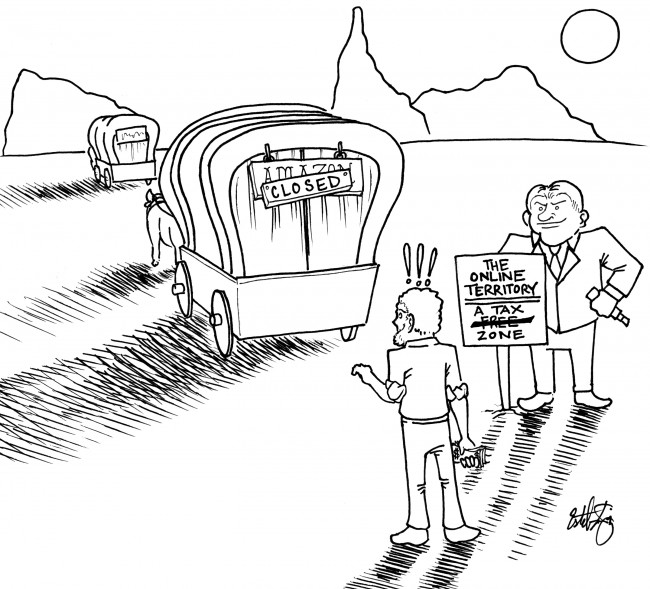

One of the many perks and conveniences of online shopping is the lack of sales tax paid when purchasing on the Web. This convenience may be at stake with many states’ pursuit of a requisite sales tax for online purchases.

Currently, states are prohibited from gaining sales tax revenue from businesses that supply to customers online. Now, however, in light of the ever-widening deficit, states search for ways to reap the benefits from this untapped economic resource.

The problem is that states must find ways around the Supreme Court ruling of Quill Corp. v. North Dakota in 1992, which determined that states are not allowed to collect sales tax unless the business has a presence, such as a location or store, in the state.

Through this ruling, Arkansas-based Wal-Mart Stores Inc. has the legal right to charge sales tax to online shoppers because it has nationwide locations – thus fulfilling the requirement of having physical presences where the shoppers reside.

On the other hand, however, if online consumers would be required to pay sales tax, one of the hardest hit online retailers would be Amazon.

One way that states are trying to bypass the Supreme Court ruling is by widening laws to include online affiliates – like blogs or coupon websites — that are located in a state as physical presences making the affiliates subject to sales tax.

The Associated Press reports that based on a 2009 University of Tennessee study, the uncollected taxes would amount to somewhere around $10.41 billion this year. This is a tremendous amount of money and on one hand, it is understandable that the government would want to take advantage of this source of income.

From the point of view of the small-business owners, online companies have an unfair advantage because consumers basically receive a better deal from shopping online because all sales lack a sales tax.

The states are also receiving pressure to reform this gap in tax collection by the physical businesses that exist throughout the states.

The best action is to prevent states from taking advantage of the opportunity to collect sales tax and enforce new laws.

Online companies are dropping sales affiliates across the country in states that require the collection of tax from online sales, with those affiliates seeing 25 percent to 30 percent drop in revenue.

Many affiliates are relocating their businesses to other states that are not looking to put a dent in online revenue through sales tax enforcement.

The standoff between the affiliates, online companies and physical businesses in states will be detrimental to only one party – the consumer.

Through the standoffs, the only results will be inconvenience and the lost of profits from all parties, except the states.

When online companies drop affiliates, both parties lose money. Physical providers may also have online stores with their products available and they will see a decreased revenue if the laws are passed.

To localize the issue, Texas will soon feel the sting of this conflict. Because there is a physical Amazon distribution center near Dallas, Amazon claims that Texans owe $269 million in uncollected taxes from online revenue.

Amazon has threatened to close this distribution center and has abandoned plans to expand in the state.

This will cost both parties. Amazon will lose revenue and the chance to expand and Texas will lose the opportunity for job creation with the discarded expansion plans.

There is no simple answer to this issue. When all parties (save the states) are almost essentially guaranteed to lose money, it is hard to create a solution that will satiate the complaints of all sides.

With that in mind, the priority of all parties should be the best and most efficient service to the consumer, which seems to be the only party that is not being considered.