Story by Corrie Coleman | Reporter, Illustrations and video by Didi Martinez | Digital Managing Editor

In January 2009, a company named Bitcoin released its first units of decentralized “cryptocurrency”: in essence, digital cash. Since then, over a thousand cryptocurrencies like Bitcoin have been created, leading to speculative conversations about the purpose and practicality of this new form of currency.

Simply understanding what cryptocurrency is can be puzzling. There is no coin or physical dollar bill changing hands. Instead, it is a long string of numbers that can be printed or stored on a flash drive to keep safe from hackers.

Dr. David VanHoose, Baylor professor of economics, said one potential benefit of a cryptocurrency is that it is not controlled by any government or backed by a third-party financial institution. Cryptocurrencies are traded directly from one individual to another. This concept, called “decentralization,” means that there is no central authority controlling exchanges.

Cryptocurrency works by creating an open database called a “blockchain.” A blockchain is a chronological list of all the transactions ever made. The information from the previous transaction, as well as the current transaction, is run through a secure code. This creates a new block, which is then added to the chain, forming a long, unique series of numbers. Network operators are constantly verifying each transaction, making it virtually non-counterfeitable.

Although the prices are volatile now in their infancy, these currencies in the future will potentially not be as affected by issues like inflation or taxation.

“One of the problems with many government currencies, including our own … is inflation erodes their value,” said VanHoose. “A dollar buys you a whole lot less today than it did when I was young.”

Cryptocurrencies are less subject to this kind of devaluation.

On the other hand, there are drawbacks. For instance, the prices of cryptocurrencies like Bitcoin have fluctuated dramatically. Last week, Bitcoin lost 20 percent of its value.

The demand for cryptocurrency changes depending on the buyers’ perceptions of its value, something that can shift quickly and unexpectedly. As the demand rises and falls, so does the price.

“With Bitcoin’s value fluctuating so wildly from week to week, month to month, there’s no predictability of value,” VanHoose said. “It could fall just as fast as it rises.”

According to VanHoose, this unpredictability means that cryptocurrencies are difficult to use as real money. Instead, it is mainly traded for profit, like a stock. Despite this instability, some businesses like Reddit and even KFC Canada have started accepting Bitcoin as payment — hoping to cash in on the cryptocurrency boom.

“We usually think of money as being something that … has at least relatively predictable value,” VanHoose said. “With [cryptocurrencies’] value fluctuating so wildly from week to week … the likelihood that it will be used as money right now is very small.”

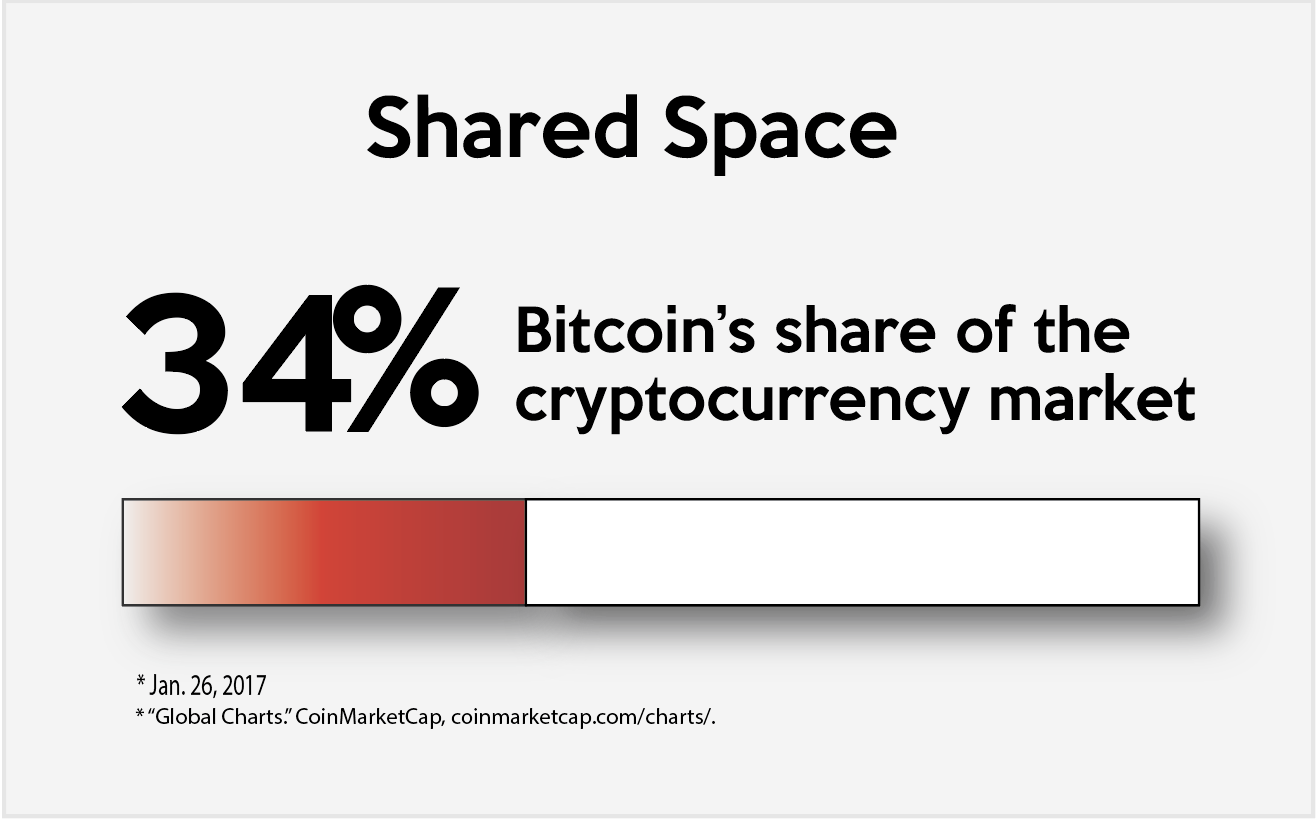

While Bitcoin is the cryptocurrency generating the most buzz, there are other “alt-coins” up for sale such as “Dash” and “Monero.”

Sacramento, Calif., junior Robin Vo bought stock in the cryptocurrency company, Ethereum.

Vo said she bought stock in Ethereum when a friend told her the investment was a good idea. After investing $2,500 for about a month, she sold her stocks for $7,500.

Vo said she wanted to invest in a cryptocurrency because she wanted to make money to help pay for her tuition. She said she was looking for a way to help her mom with the cost of Baylor.

“I think it would be a good idea [for others] to invest,” Vo said, pointing out that the dramatic fluctuation of value is what helped her make a 300 percent profit. “It’s been totally worth it.”

Coppell senior Surbhi Todi invested in Bitcoin a few months ago because she predicted that the prices would rise. She initially invested $200 and has now made thousands of dollars in profit. Her method for investing involves very little risk.

“As soon as I hit the price that I’ve invested, I take that much money out,” Todi said. “So if I invest $100, and I make $100, I take out my original $100 and with the [remaining] money, I reinvest.”

HOW CRYPTOCURRENCIES ARE PERFORMING

Even if the value of Bitcoin falls, Todi is assured she will never lose her initial investment.

“I’m less risky of an investor,” Todi said, comparing herself to others who invest thousands into cryptocurrencies only to see the prices fall before they can make a profit.

In the coming months, Todi wants to invest more of her money in smaller cryptocurrencies in case Bitcoin’s value plummets in the future.

Todi said she plans to use her investment profits to travel to India this summer.

Vo and Todi use websites like GDAX, Bittirex and Coinbase to buy, sell and track the prices of cryptocurrencies.

Nevertheless, the future of Bitcoin and other such companies is uncertain. As its value rises and falls, even experts cannot predict its fate.

“It’s kind of taken a life of its own,” VanHoose said.