Baylor University offered over $183 million in scholarships last year, according to data collected by the Office of Institutional Research and Testing. These scholarships are awarded to students who have financial need and students who don’t.

However, a recent survey from the Investment Protection Institute (IPI) reveals that 49 percent of millennials surveyed still have college-related debt.

“Student debt is increasing at an exponential rate,” said Juan Mejia, a Baylor Student Financial Foundations peer coach. “Our student debt for millennials is over $1.3 trillion, so that being said … do we understand what we’re getting ourselves into?”

Jackie Diaz, Baylor’s assistant vice president for student financial services strategy and planning, said she sees students who over-borrow in order to meet the estimated cost of attendance, which includes tuition, room and board, books and supplies, personal expenses and transportation.

“Every student needs to budget so that they know their own personal cost of attendance,” Diaz said. “You can make decisions that will greatly reduce that general cost of attendance, and that’s what you need to do if finances are a challenge for you.”

Both Diaz and her assistant, Donna Bowman, said budgeting and saving money now are two of the most important things college students can do.

“It spills over into those bigger decisions about buying a home, saving for retirement,” Bowman said.

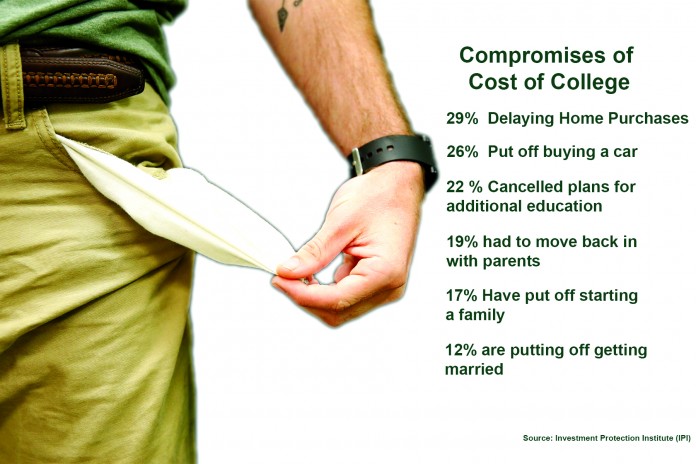

According to the IPI survey, 56 percent of millennials say they worry they will have to work longer to save for retirement, 29 percent are delaying home purchases, 26 percent have put off buying a car, 22 percent have cancelled plans for additional education, 19 percent have had to move back in with parents, 17 percent (including married individuals) have put off starting a family and 12 percent are putting off getting married.

“Our focus right now is to launch students into a career that will make these decisions possible, and to do it in a very wise way so that they can go into post graduate life having made good decisions early on,” Diaz said.

Baylor’s Student Financial Foundations has added a new tool called iGrad to help students learn more about managing their finances.

“We are excited about the tools that are available now in financial foundations,” Diaz said.

iGrad offers resources for financial literacy, including courses, articles, videos, various financial calculators and a chat room with advisers. The calculators address topics such as affording a home, paying off loans based on income, paying credit card bills, investing, budgeting and planning for emergencies.

In addition to iGrad, Financial Foundations also has an online CashCourse program and a Finish N 4 video series about completing a degree in four years.

Diaz said it should be students’ goals to graduate in four years to avoid paying for a fifth or sixth. She said she discusses students’ majors and career plans in order to help keep them on track.

Bowman said the program also offers workshops about budgets, scholarships and applying for jobs to help students afford school. There is also a seminar for seniors to begin discussing loan payment options after graduation.

Appointments can be made to meet with someone from Financial Foundations by calling 254-710-3109 or emailing them at Financial_Foundations@baylor.edu. Their office is open Monday through Friday, from 8 a.m. to 5 p.m.

“It’s preparing now for the future,” Bowman said.