Michael Tillinghast

and GT Thompson

Reporters

One year before enrolling at Baylor for the 2010 fall semester, hospital corpsman Rachael “Doc” Harrelson was rendering aid to fellow shipmates in Afghanistan and Iraq.

Now Harrelson is more concerned about financial aid than rendering aid.

The Hewitt senior served eight years with the Navy and deployed to Iraq for Operation Iraqi Freedom in 2003, and Enduring Freedom in 2005, aboard the USS Harry S. Truman, an aircraft carrier stationed out of Norfolk, Va.

Now married with children, Harrelson said her transition to college was difficult. It was tough mentally and financially. Having to pay for college and support a family presented many challenges.

“I actually began taking college courses while I was serving in the Navy,” Harrelson said. “Once I was out, I began college full time, and I realized how different things were.”

Some veterans have a working spouse and school-aged children. Some have said they find it hard to contribute financially and difficult to find the time to fully tend to their household.

Marlin junior Justin Horvath is a student veteran who served 10 years active duty in the U.S. Army.

“Going to school is a challenge because of money and a rigid schedule, but it is better than the Army because I have more family time and we don’t have to move around,” Horvath said. He is married with three children.

Although Harrelson said she’s doing OK now with the help of financial aid, she said she had to struggle and find ways to help pay her tuition when her benefits ran out in April 2012.

The GI Bill provides up to 36 months of education benefits. Generally these benefits are payable for 15 years following release from active duty, or veterans can transfer their GI Bill benefits to dependents.

“The military extended my benefits to finish through May, but then I needed to find a way to pay off my last year here,” Harrelson said. Being a transfer student as well as changing majors added on more schooling for her than the GI Bill covered.

“Baylor was outstanding in helping me to get a few loans and scholarships together,” Harrelson said.

She shared advice for veterans who also need help to pay tuition.

Harrelson said she relies on the Rhonda S. Reynolds Departmental Scholarship for the Communication Sciences and Disorders Department, Baylor Institutional Loan, Transfer Baylor Scholarship, a need-based scholarship and the Texas Tuition Equalization Grant. She will graduate in May with a bachelor’s degree in communication sciences and disorders–speech language pathology and a reasonable amount of loan debt.

“I was accepted to graduate school this summer, and I am looking for ways to cover this as well,” Harrelson said. “Seeing as my husband is active duty, I will be using his GI Bill benefits for the next three semesters; however, the GI Bill only covers $17,500 a year, and my cost will surpass that.”

But she has one more secret weapon, which is found in her faith.

“We put our faith in God, and we know that no matter where we are stationed, it’s for the best,” Harrelson said

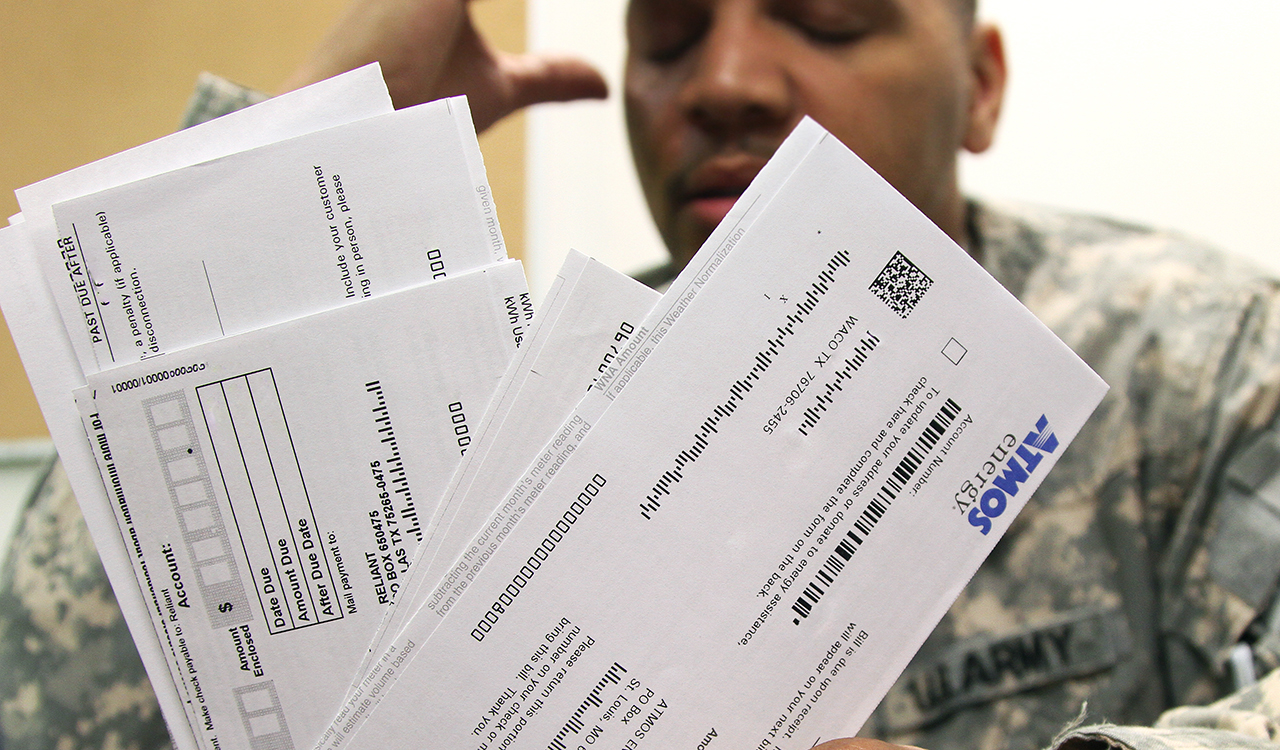

Waco senior and Navy veteran Ashley Groke said the burden of making ends meet during the breaks from school is financial strain.

“It’s important to be prepared for the winter and summer breaks if you aren’t attending school full time,” Groke said.

Veterans using the Post-9/11 GI Bill are not paid their monthly living allowance in-between sessions, and for partial months, the benefits are pro-rated.

“I just recently started working at CVS Pharmacy, and this money will primarily go toward saving for the months that we have breaks from school,” Groke said.

Groke said she realized she needed to work a steady job to keep her tuition and other costs covered.

“In fall 2011 my husband still had a year to fulfill on his contract, so we were separated for a year while I came to Baylor,” Groke said. “It was hard trying to find a place to live in Texas while living in California and difficult to split our furniture and bills to support two rents and two sets of bills.”

Life at the Grokes’ house is easier, thanks to the Chapter 33 Post 9/11 GI Bill and Yellow Ribbon, which helps cover college tuition, books and living expenses.

Together with the state of Texas, however, Baylor is part of the Yellow Ribbon program, a fund that helps students meet the higher cost of a college education without having to expend more of their Post 9/11 entitlements.

“This is truly a blessing,” Groke said. “Everything is 100 percent covered. In addition to tuition, we receive a housing allowance and a book stipend each semester.”

Current provisions of the Chapter 33 Post-9/11 GI Bill do not include benefits during school breaks, unless they are taking summer classes.

Dallas senior Sgt. Josiah Johns is currently in his first school year back after serving in the military. After serving he decided to forgo other positions in the military in order to complete his degree in international studies, which he began prior to his deployment.

Having gone to Baylor both before and after his service, Johns had an advantage because he knew what he was coming back to. However, there were still obstacles.

“College at a well-off university like Baylor is about as polar opposite as you can get from war. The transition is not easy,” Johns said.

Johns said he was fully aware of the programs and bills in place that would provide funding for his education. The problem was that he was unaware of any services or programs that Baylor provides to veterans in order to complete a smooth transition.

Baylor’s registrar’s office has benefits and programs set up, but veterans such as Johns have had troubles in their enrollment and transition.

Johns ran into difficulties trying to transfer credits and release holds that had been put on his registration.

“I gave them a year heads-up of my situation,” Johns said. “I was trying to make my return easy for Baylor and myself. But when I got back, it was a nightmare trying to get everything in order.”

The university registrar has a Veterans Affairs office, located in Robinson Tower, to provide information to military students and their families regarding financial opportunities and programs that are offered by the university, making the transition from active duty to university life much smoother.

As a private university, Baylor offers attending veterans a number of benefits from the GI Bill and other scholarships, although not all articles from the GI bill are applicable to the school.

One major aid program not offered by Baylor or other private institutions is the Texas Hazlewood Act, which provides 150 hours of tuition exemption to student veterans at state schools around Texas. Baylor does not offer this because it is a private institution. This program is only offered by state-funded schools.

Eighty of Baylor’s student veterans are on financial aid and most Texas schools make use of G.I. Bill Chapter 33, the “Post 9/11” clause that provides tuition, housing allowances and other benefits to members who served after 9/11. Baylor does not require student veterans to register as such so the total number of student veterans is unknown.

Other financial opportunities that are offered to Baylor veterans include the Montgomery G.I. Bill Chapter 30, the John Fry Scholarship that is available to the college-attending dependents of veterans, and a potential upcoming military work-study program.

The Veterans Affairs work-study program was created by Baylor’s Veterans Affairs specifically for beneficiaries of the G.I. Bill to alleviate rising tuition costs that might strain the financial aid of post-9/11 and other entitlement programs.

The work-study program will focus on positions within the Texas Veterans Affairs, including posts in veterans care facilities, national cemeteries and universities interacting with other veterans and service members.

Another issue for veterans who have served less time is the recent cut of the Federal Tuition Assistance (FTA) program that aids those who have served less than 3 years.

“There is a movement in America to support the veterans but the FTA ends up being one of the first things cut,” Johns said.

Together with Harrelson, Horvath and Groke, veterans like Johns are adjusting as best they can to the college life here at Baylor.

Relying on financial aid can be a risk, but with the support from Baylor and government programs, veterans here may be able to breathe a little bit easier.