and Ashley Pereyra

Reporters

Completing the Free Application of Federal Student Aid (FAFSA) is an integral part of helping to pay for college for most students. However, not many of them actually do it themselves.

Houston senior Amanda Padilla said her parents have completed her FAFSA application every year that she has gone to Baylor.

“I started to do it sometimes, but for the most part I just know it’s going to be a hassle,” Padilla said. “So I let my parents do it.”

New Orleans junior Taylor Jones works on the FAFSA application with her parents, and she said she understands the need students have for financial aid to be able to pay for college.

“College education is expensive,” Jones said. “I feel like it’s one of the fastest increasing sectors of our economy, so if you qualify for government aid, why wouldn’t you take it?”

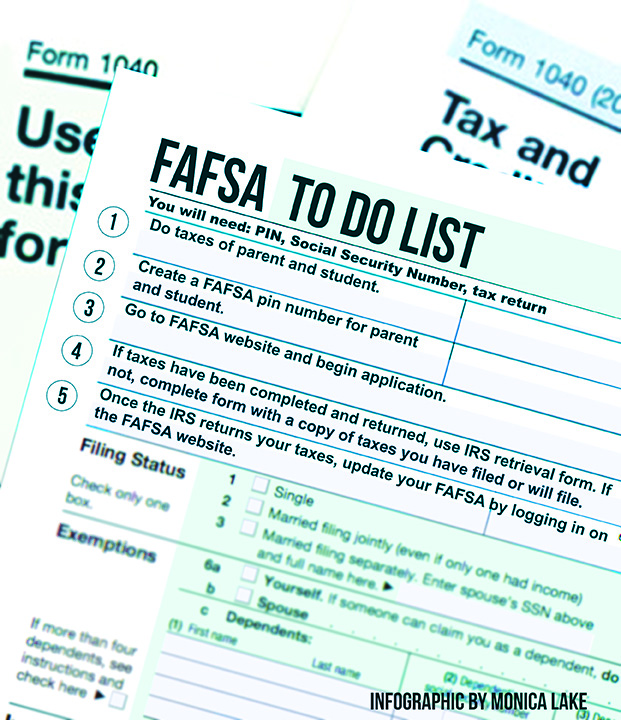

In order to begin a FAFSA form, students and/or their parents need two sets of completed tax return information—their parents’ and their own from the current year. If that is not available, then use the information from the taxes that have submitted or will be submitted. The correct information can be updated on the FAFSA website using a pin number once the parent’s current tax information becomes available.

A pin number can be an important tool as it is the fastest way to sign the application. Students and parents apply for their own pin numbers on the Federal Student Aid Website. The pin not only works as an identifier, but it allows access to the online student aid report and corrections can be made if needed.

Once pin numbers have been acquired, completing the application online becomes a simple process.

For Baylor students, the application for the 2013-2014 school year was available to submit after January 1.

The priority deadline to submit the FAFSA to Baylor was March 1. Students who file for aid before the FAFSA deadline are given priority in considerations for financial aid. After the March 1 deadline, funds will be distributed based on availability.

Although completing the FAFSA application can be simple, things like late tax returns can lead to a more complicated and sometimes frustrating process.

According to the Department of Education, this year there was a major delay on processing tax returns. Jeff Baker, director of policy liaison and implementation with the U.S. Department of Education, issued a statement on March 13 and said the delays had the potential to impact students and their college enrollment decisions.The IRS data retrieval form was rendered useless for the people this delay affected. The retrieval form simplifies the FAFSA application process as it takes information directly from the IRS.

The retrieval form was implemented into the FAFSA process in January 2010. The Department of Education realized that there was a need to simplify and streamline the FAFSA process in order to make it easier for families applying for aid.

The IRS issued a statement on the delays last month. They said that they were aware of a limited number of software company products that affected some taxpayers who filed form 8863, Education credits, between Feb. 14 and Feb. 22.

This caused those tax returns to require more review by the IRS.

The FAFSA website also acknowledged the delay.

In Baker’s statement, he listed what to do until the tax returns were in. The current federal deadline for the FAFSA is June 30. However, in Texas, it depends on the school.

For example, Baylor has set a priority deadline of March 1.

As Baker said, a student can file an initial FAFSA with their copy of the tax return but without the processed return. After the tax return comes in, then the student can update their FAFSA with final, correct information.

If tax returns are late, the Department of Education said there are a number of ways to approach this problem.

“We offer a tool online, and it’s called the FAFSA forecaster, “ Christine Isett, the Department of Education representative said. “And students are still able to apply the previous year’s tax information in there to get a better idea of an estimate of what they may be eligible for. Also, they can work with their financial aid office. The financial aid office can help them complete their FAFSA.”

Isett said despite the delays, the correct information needs to be put onto the form.

“The FAFSA does require that you provide current year tax information,” she said. “Although there are delays, we know eventually that information needs to be provided for verification purposes.”